The Nitty Gritty

- Understand how your business's cash flow is crucial for success

- Learn how markup and margin are essential metrics for assessing your business's health and profitability

- Discover the difference between markup and margin

- Find out how to avoid mistakes in markup and margin calculations

One of the worst mistakes you can make with your business is not understanding your cash flow. What are your inventory and labor costs? How much is your gross and net revenue? Basically, where is your money going? Two key metrics for determining your business's health are markup and margin. These are used to answer those questions and determine how much money you're spending versus what you're bringing in.

If you're confused about the difference between markup vs margin. You're not alone. In this blog, we'll cover their definition, related terms and how to calculate them, as well as how to determine the right profit margin for your business. Let's dive in!

Introduction to Business Profit Metrics

Owning and running your own business is no small feat. At any time of the day, there are countless things to do and projects (and people) to handle. And let's face it, you probably didn't get into the business to do math all day long.

But, when it comes to your business's health, it's really important to do that math. After all, you're in business to make money, and if you don't know your margins, there's a chance you won't know you're not profitable until it's too late.

Part of the problem with business profit metrics is there are a lot of terms: sales, cost of sales (sometimes known as cost of goods sold or COGS) and gross profit. Before we dive into markup vs. margins, let's first sort out these key terms before we use them in other definitions.

To help explain, imagine you want to know your markup and margin for $10,000 in sales. To make that $10,000, it cost you $4,000 in materials, labor and other resources.

Sales: The money you collect from your customer when you sell something is what we're referring to as "Sales." In the business world, there are a lot of different terms used to mean how much money a company makes (e.g. revenue, profit, EBITDA ). But to calculate markup vs. margin, you only need the raw invoice totals, or sales. For our example, that's $10,000.

Cost of Sales: The cost of sales is how much it cost you to make the sales you're basing your other calculations on. Costs can include anything from labor, materials or any other job-specific costs such as subcontractors or equipment. For our example, the cost of sales is $4,000.

Gross Profit: In the simplest terms, profit means how much money you made. There are several definitions once you get further in the weeds, but for markup and margin, all we care about is gross profit. Luckily, this is one of the simplest equations: Gross Profit = co[Amount of Sales] - [Cost of Sales]. So, using our example of $10,000 in sales that cost $4,000 to make, the gross profit is $6,000.

Markup vs Margin: Defining the Terms

It's easy to confuse markup and margin, since they both are used to show how much your company makes. The key difference is how they're calculated: one is based on your costs, and the other is based on your sales. So, which is which?

What is markup?

Let's say our $10,000 in sales from our previous example is from selling a new HVAC unit. That unit cost your business $4,000. That's $6,000 in gross profit. To figure out how much you marked that unit up (the markup), this is the formula:

So the numbers look like this: ($6,000/$4,000) x 100 = your markup. If you got 150% as your markup, you're absolutely right.

What is margin?

While markup is determined based on how much something costs you, margin is calculated using your total sales. Using our same example of the $4,000 HVAC unit that you sold for $10,000, your gross profit is still $6,000. The formula for gross margin is:

So, gross margin = ($6,000/$10,000) x 100. That's a 60% gross margin for our example.

Unpacking the Difference Between Markup and Profit Margin (With Examples)

As we discussed earlier, terms about business financials can easily get confusing. Talking about markup vs profit margin vs profit can make your head spin. Let's see how these three metrics play out in a couple of examples:

Markup vs margin example 1: the bathroom renovation

You recently completed a bathroom renovation job, amounting to $40,000. Labor cost $22,500 and materials cost $12,000. Let's calculate the markup and margin.

Gross Profit: $40,000 - ($22,500 + $12,000) = $5,500

Markup: ($5,500/$34,500) x 100 = 16%

Margin: ($5,500/$40,000) x 100 = 14%

Markup vs margin example 2: summer cooling maintenance

This summer, you have several customers with an HVAC maintenance plan amounting to $36,000 in planned sales. Labor cost $13,000, gas and vehicle maintenance cost $6,200 and materials cost $2,000. Let's calculate your markup and margin.

Gross Profit: $36,000 - ($13,000 + $6,200 + $2,000) = $14,800

Markup: ($14,800/$21,200) x 100 = 69%

Margin: ($14,800/$36,000) x 100 = 38%

Visualizing the Differences: Markup vs Profit Margin Chart

Something you may have noticed is markup should always be larger than margin. If it's not, you've either made a calculation error or something is very wrong with how you're pricing your products and services.

Using the two examples above, our markup vs profit margin chart shows the relationships between gross profit, markup and margin:

The Ideal Numbers: What Profit Margin Should You Aim For?

Pricing varies for every business, and a lot of factors go into how you set your prices. Everything from how much competition you have (and how good they are), your customer sentiment and reviews, to how much your supplies and employees cost. This means there's no magic number for the "right" profit margin. Additionally, if you aim too high with your margin, you'll likely outprice yourself, losing business. But set your prices too low, and you may have an influx of business that you can't keep up with, burning you and your team out.

It's also important to consider, much like with our examples above, your profit margin can differ depending on what services you offer. It'll likely differ even between jobs and will most certainly change over time. Selling physical products generally have thinner margins than services, with many businesses opting for maintenance plans as their "cash cow."

Let's look at a few industries and their average profit margins. Restaurants traditionally run on very thin margins, often only 3-5%, while construction companies top out closer to 7%. Technology companies often have much larger margins, sometimes reaching upwards of 50%.

To find your business's ideal profit margins, you'll need to take a good look at your books, where you spend your time and money, and create the right balance for all the services you offer.

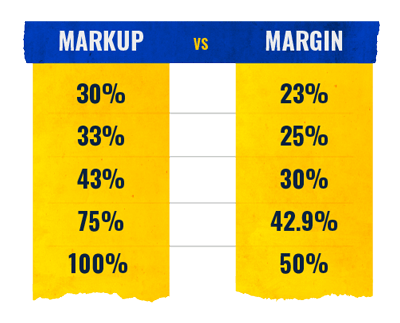

Translating Markup to Margin: An Essential Table

As we detailed above, your markup should always be higher than your margin. For example, a 30% markup will give you a 23% gross margin, a 43% markup equals a 30% gross margin and 100% markup gives you a 50% gross margin. This chart details the relationship between markup and gross profit margin:

Using the table above, you can forego some of the math we discussed earlier and know your margin by choosing a specific markup. For example, if you're selling tankless water heaters at a 43% markup, you know your profit margin on those water heaters is 30%. However, if you have different markups for different services, you'll still want to calculate your overall business profit margin using the formulas detailed above.

Reducing Margin vs Markup Mistakes

Now that you understand the difference between margin and markup, make sure to use the knowledge to ensure business profitability and growth. Here are some ways you can reduce your mistakes (and math) when calculating these important financial metrics:

Implement a pricing tool to quote sales

When shopping around, one of the first things people often look for is affordability. Clearly seeing an item’s cost, whether it's the installation of a new bathroom or just a new toilet brush, knowing the costs is key. With a field service management software solution, you can provide quotes to customers that detail all the costs involved for a project, no matter its size.

Educate your sales team

There are a lot of moving parts to any business, and you need to make sure each department is informed. When it comes to the cost of services or goods, the sales team needs to know the right details to pass on to customers. With a large portion of revenue being brought in from your sales team, it’s important to make them aware of the difference between your markup and margin percentages. Especially for the different products and services you offer. In addition, ensure they have the heads up when any promotional offers or price increases occur.

Consider hiring a professional accountant

There are, unfortunately, only so many hours in the day. Even if math is your thing, your time may be better spent elsewhere in your business. Especially with all the rules and regulations, tax considerations, and more. Hiring an accountant to help you figure all this out may be a good call. Just make sure you look for a certified public accountant (CPA); they'll be able to help with all your financials, including taxes.

Mastering Markup and Margin for Business Success

Regardless of whether you take on professional accounting help or not, it's still important for you to understand how your business financials work. With the definitions, examples, and markup vs. profit margin charts we provided in this blog, you’ll be well on your way. Adopting field service management software can help keep everything on the straight and narrow, including your financials. By centralizing all your work and data, from customer info, invoices, projects and more, you can easily keep track of your business's health.

Request a demo to see how Simpro can help improve your business efficiency and help you make smarter business decisions.

Editorial Note: This article was originally published in August 2022. It has been updated for accuracy and comprehesiveness.