Easily improve your field service business cash flow

Simpro Premium is the easiest way to estimate, invoice, take payments and see where you’re making and losing money. Improve field service cash flow with Simpro.

Request DemoEstimating and Quoting

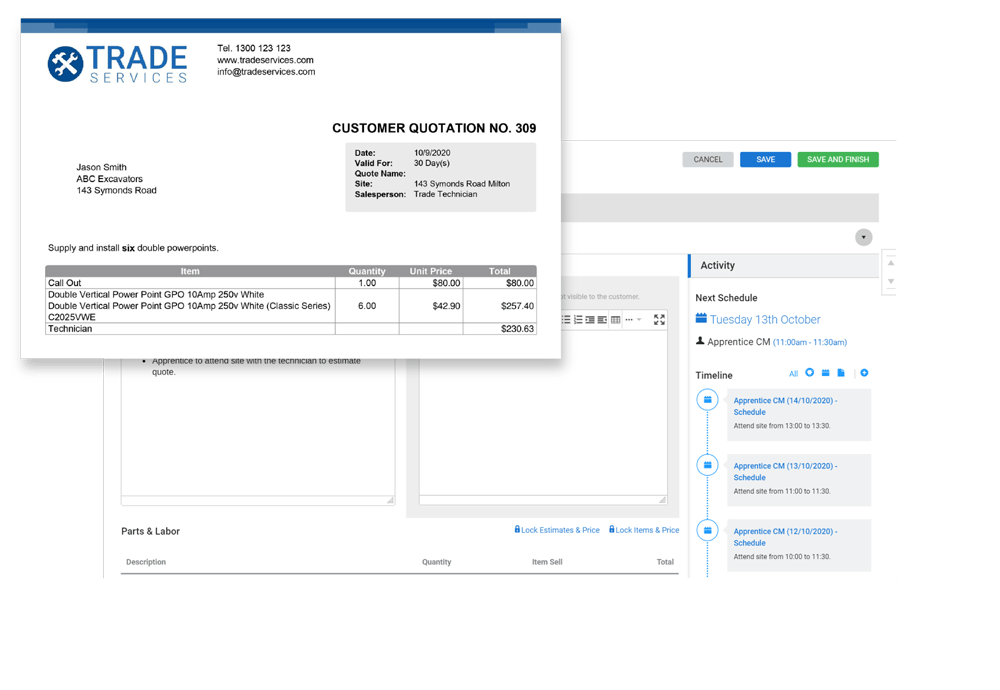

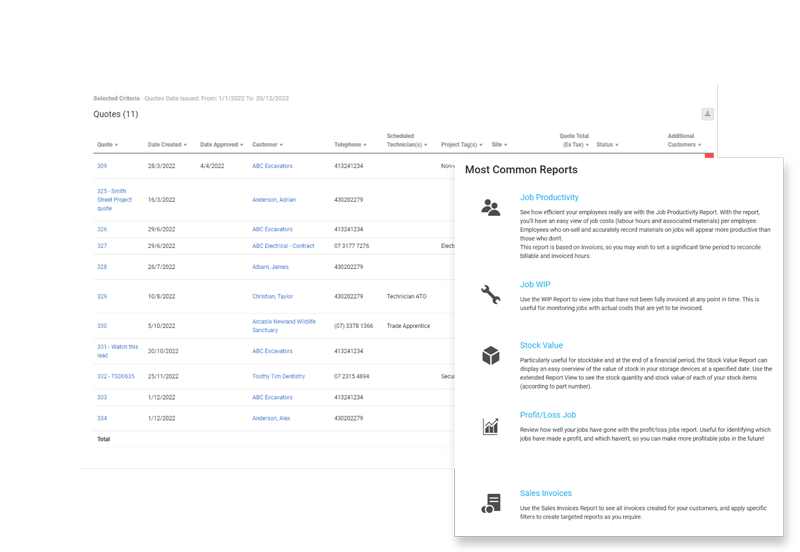

Build accurate estimates and quotes

Start off on the right foot with customers. Whether you need a service quote or a fully costed proposal for a complex project, easily create, update, send and schedule quotes.

Create and present multiple customized quote options from the office or on-site. Plus, easily make updates based on preferences for materials, labor and pricing.

Simplify estimating. Use online quote acceptance for quick approvals then convert the accepted quote into a single or recurring job.

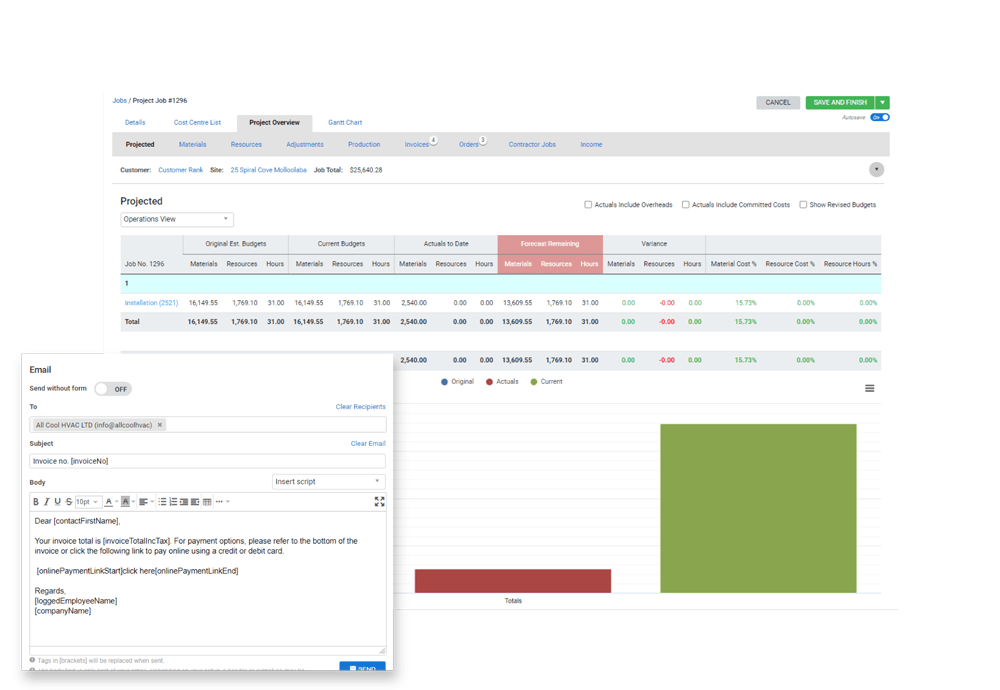

Make every job profitable. View budgeted costs for all billable and non-billable labour and materials, to analyse the impact of changes on gross and net margin and profit/loss.

Track spending against your estimated budget and quickly adjust your current budget to account for any changes.

Takeoffs

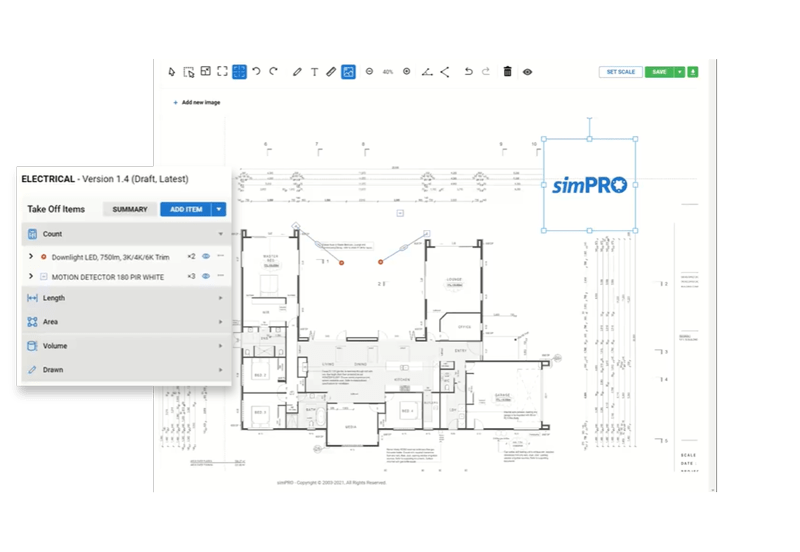

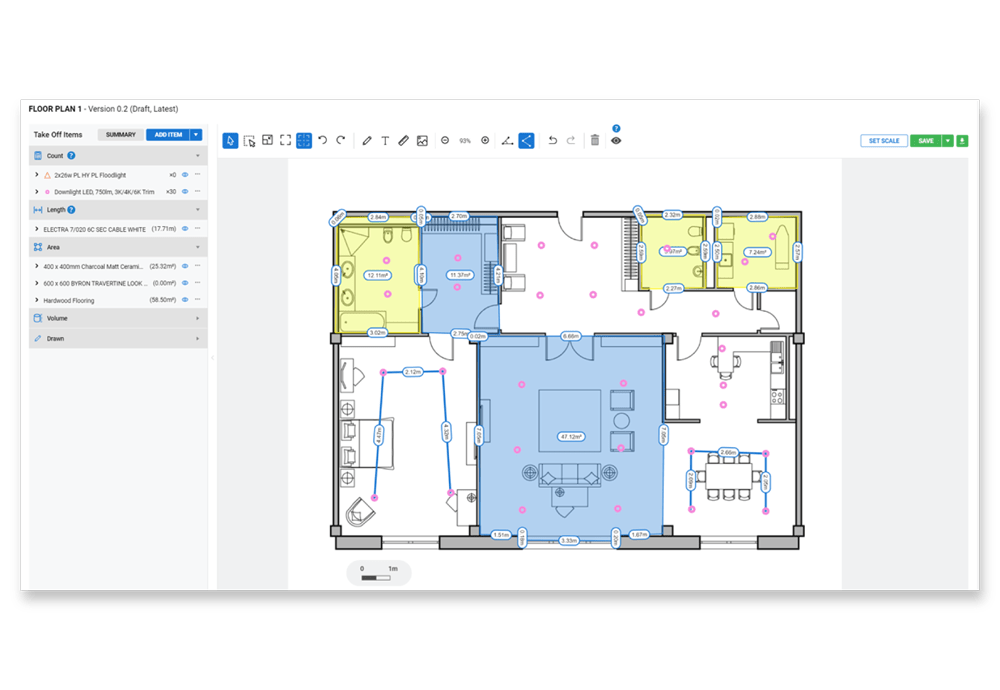

Take off with quick, accurate estimates

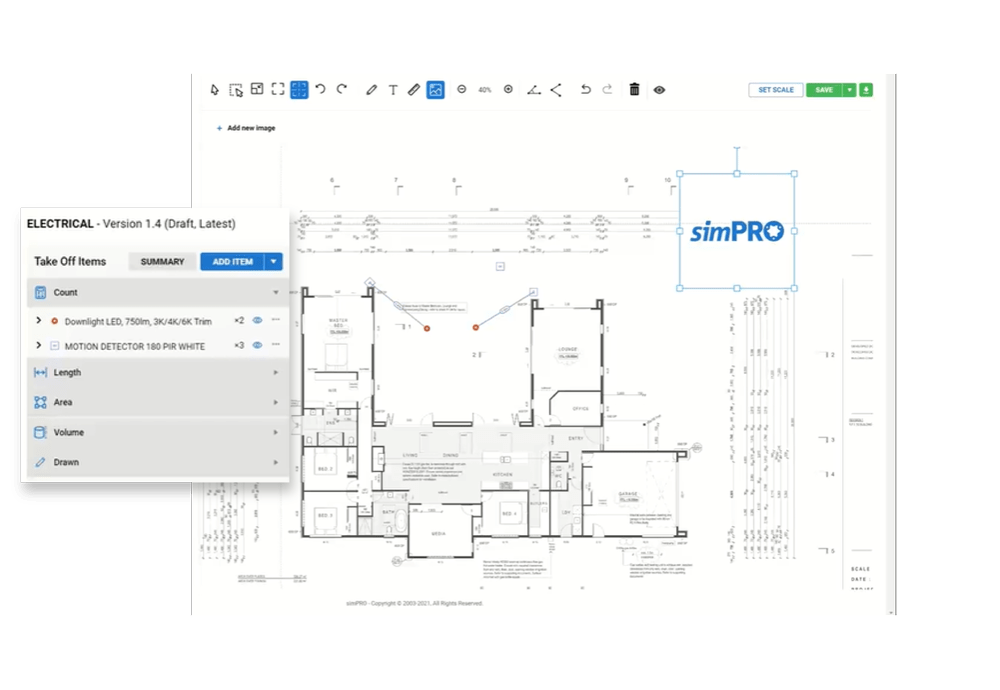

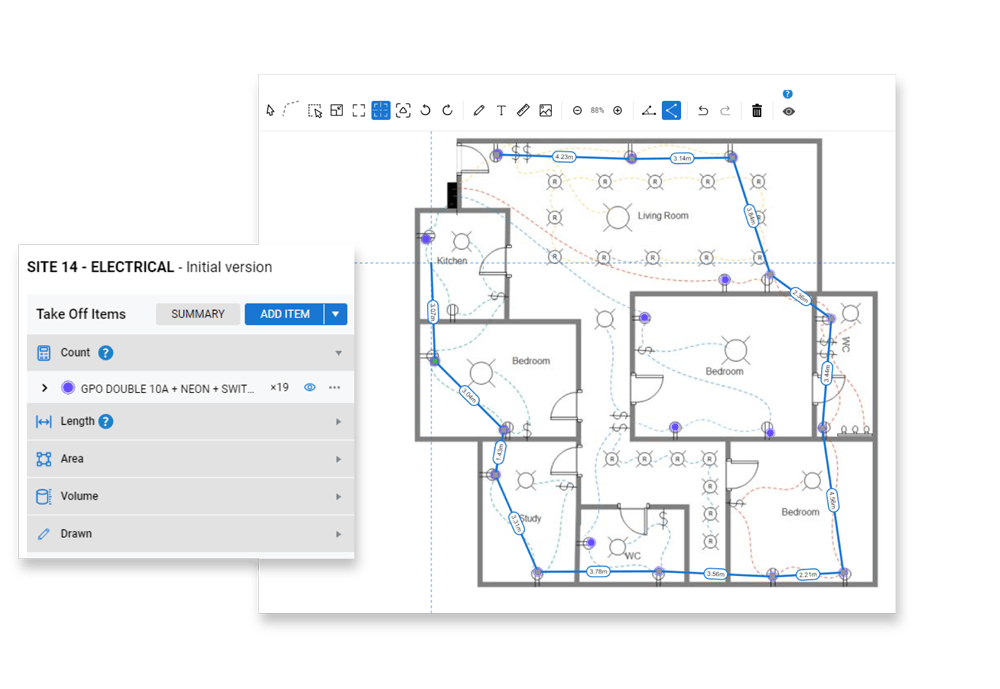

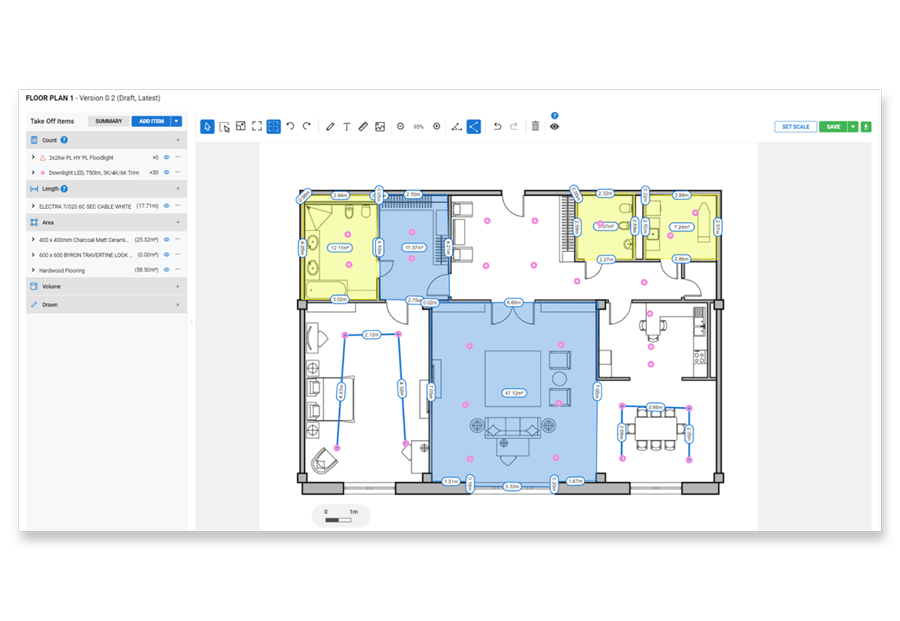

Produce fast and accurate take offs from anywhere with Simpro Premium’s Takeoffs add-on. Upload a plan, set your scale and start drawing, measuring and marking up in an instant.

Simply upload a plan, set your scale and get drawing. Count and measure lighting fixtures, wiring, piping, areas of flooring and more.

Create your list of material estimates with associated fit times and update these directly into your Simpro cost centers.

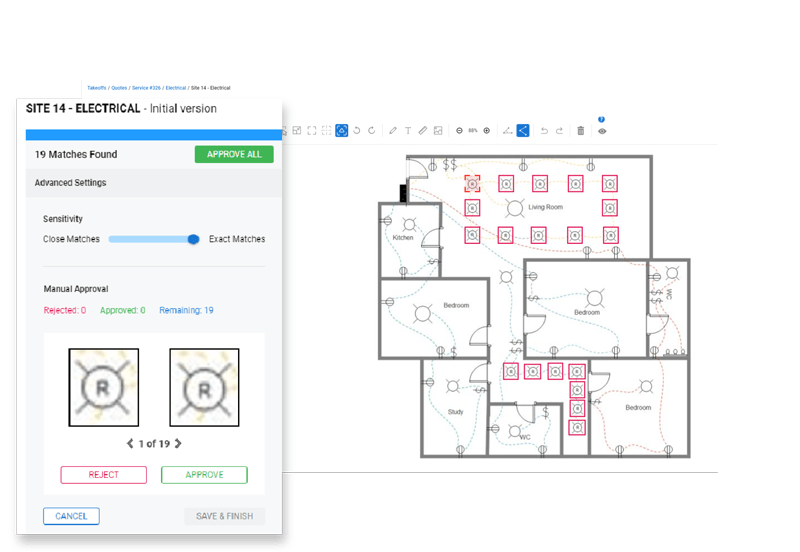

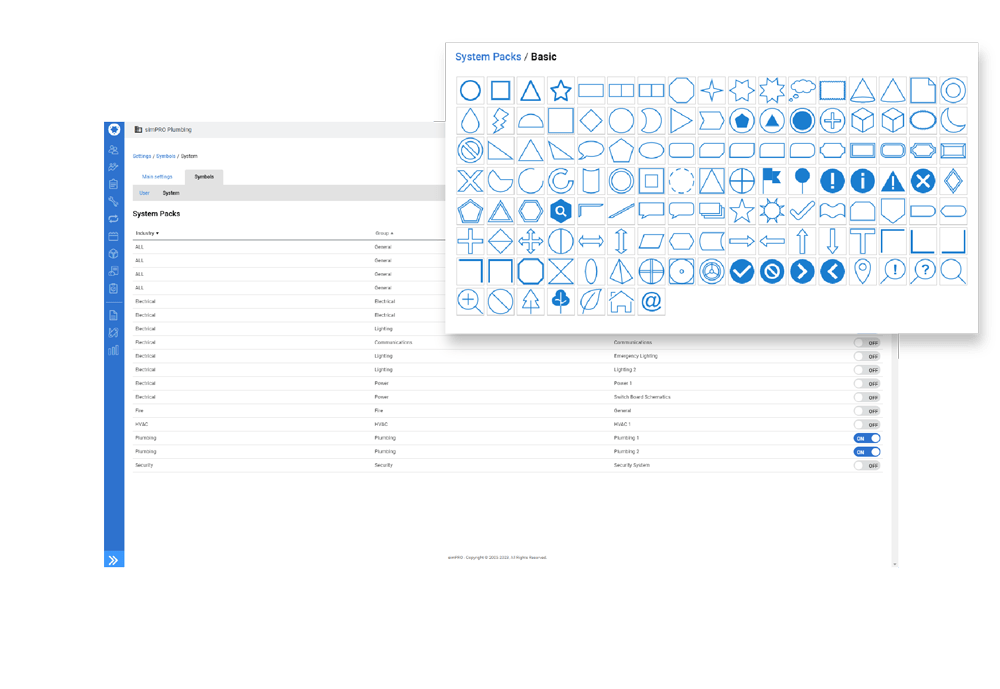

Mark up drawings and count items in seconds with the smart symbol recognition tool, that can read all orientations.

Estimate faster with the ability to add a plan from a quote, job or a device then easily select which pages to use. Set the scale, crop the plan, add your logo, and off you go.

Whether in the office or on-site, use Simpro Takeoffs anywhere. Sketch and mark-up on the fly at customer sites on tablets and view marked-up drawings via attachments on Simpro Mobile.

Take into account the differences between the final drawing and what was achieved on-site with as built drawings.

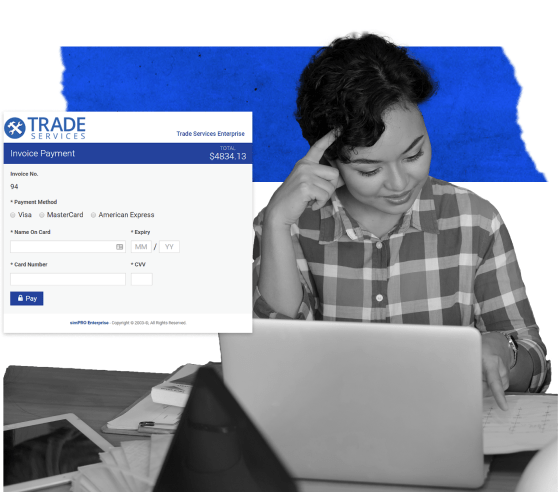

Invoicing and Recurring Payments

Invoice from anywhere

Do you spend more time chasing payments than running your business? Not anymore! Make invoice creation a breezy affair both in the office and on-site.

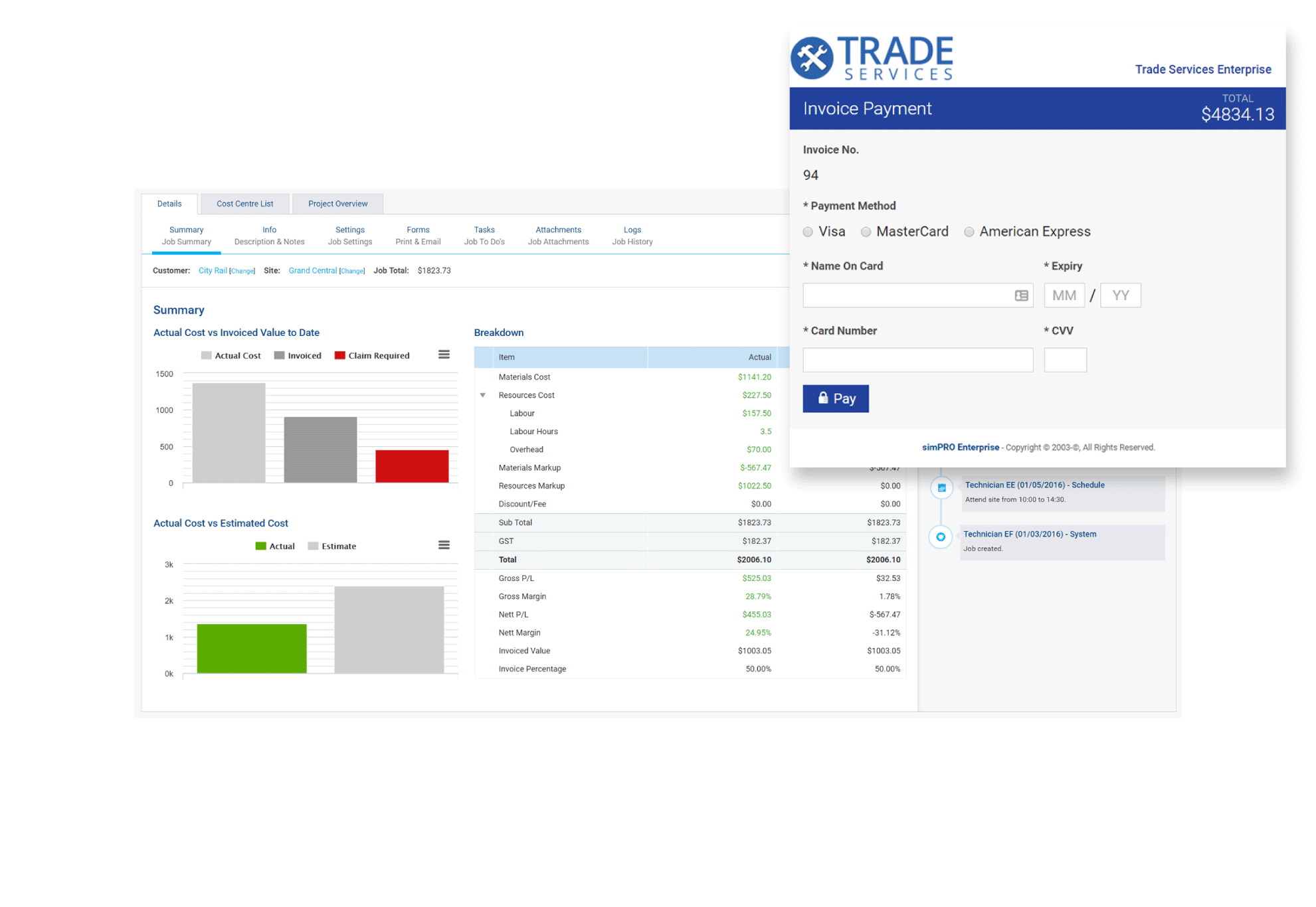

Ready to invoice? Review the job card, collect technician and customer signoff, then proceed to invoice and payment from Simpro Mobile, or trigger office-based invoicing.

Keep on top of billing for ongoing jobs without lifting a finger with recurring and automated invoicing. And, you can also give your customers the choice to set up automated payments via Square or the Customer Portal.

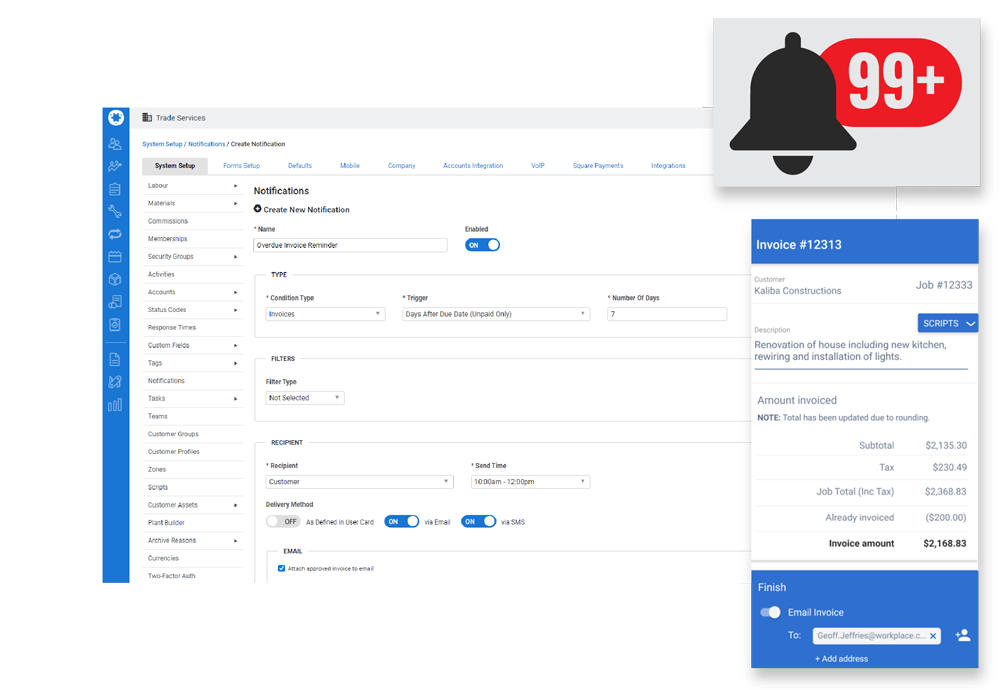

Avoid payment delays with automatic SMS and email reminders to customers. Create your own message and rules such as frequency, send time or trigger events.

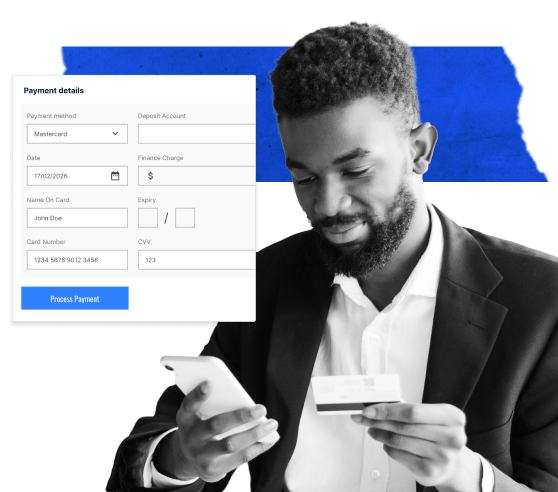

Payment options

Get paid faster with multiple payment options

Improve cashflow

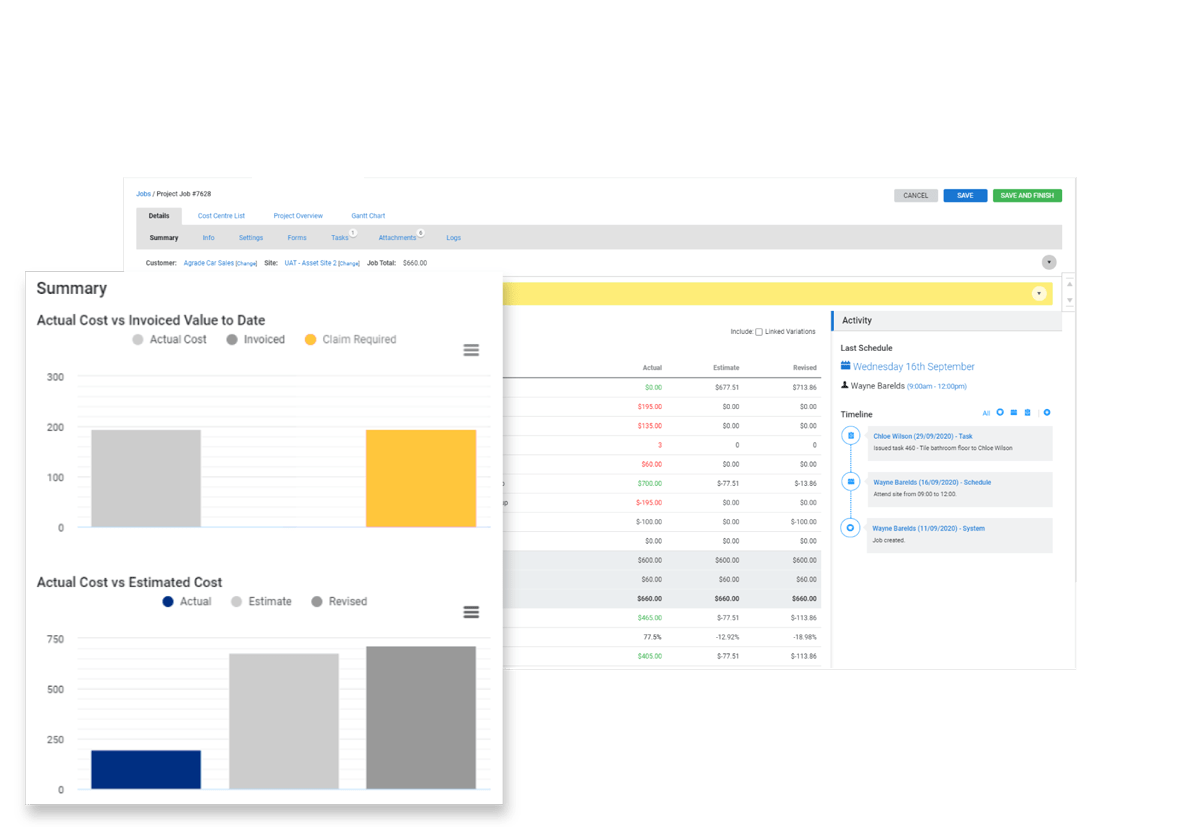

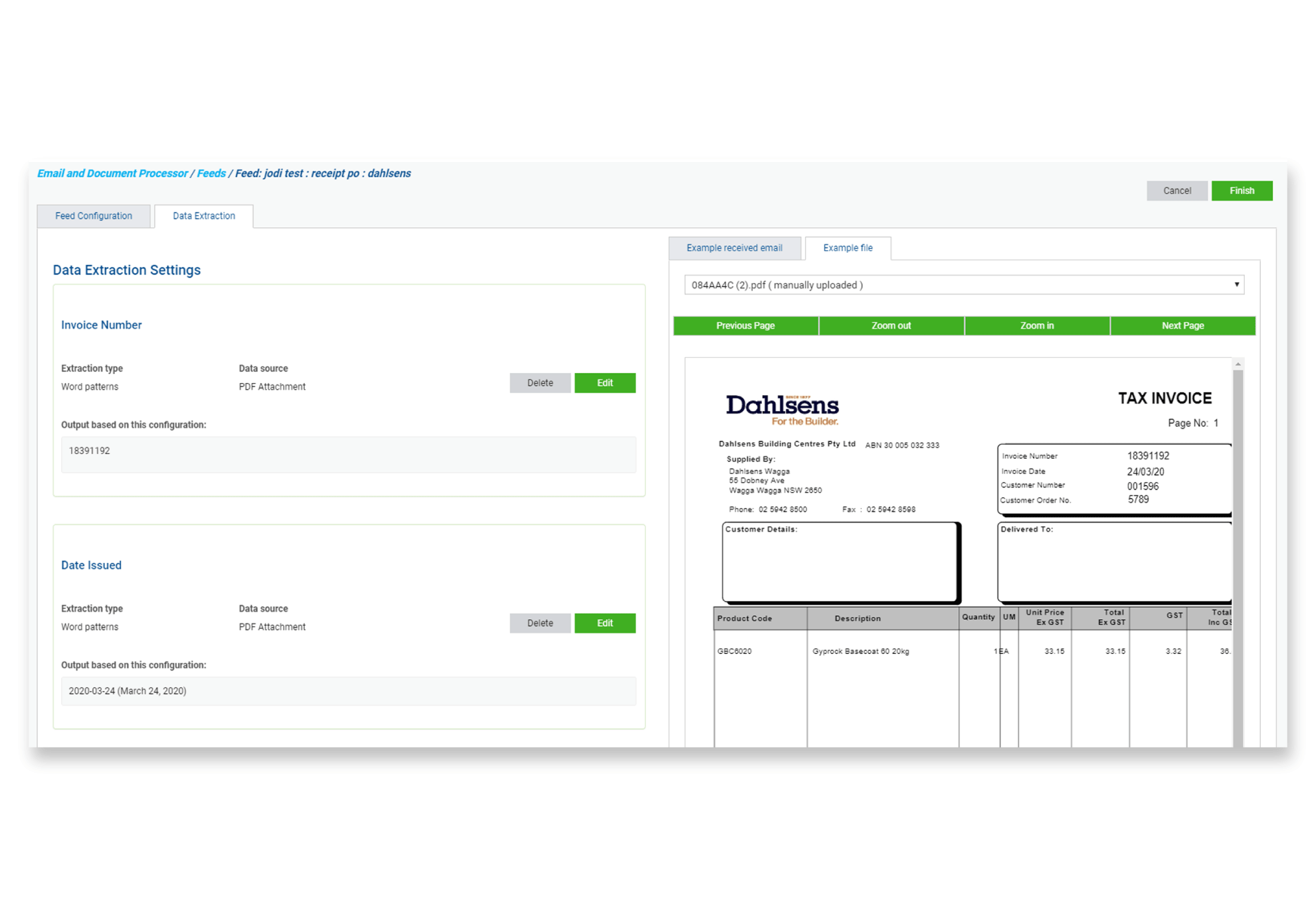

Financial insight with accounting integrations

Make strategic decisions and save time cross-referencing with financial data flowing from Simpro to your accounting software and back again.

View All Integrations